How to Check Your Credit Score in the USA

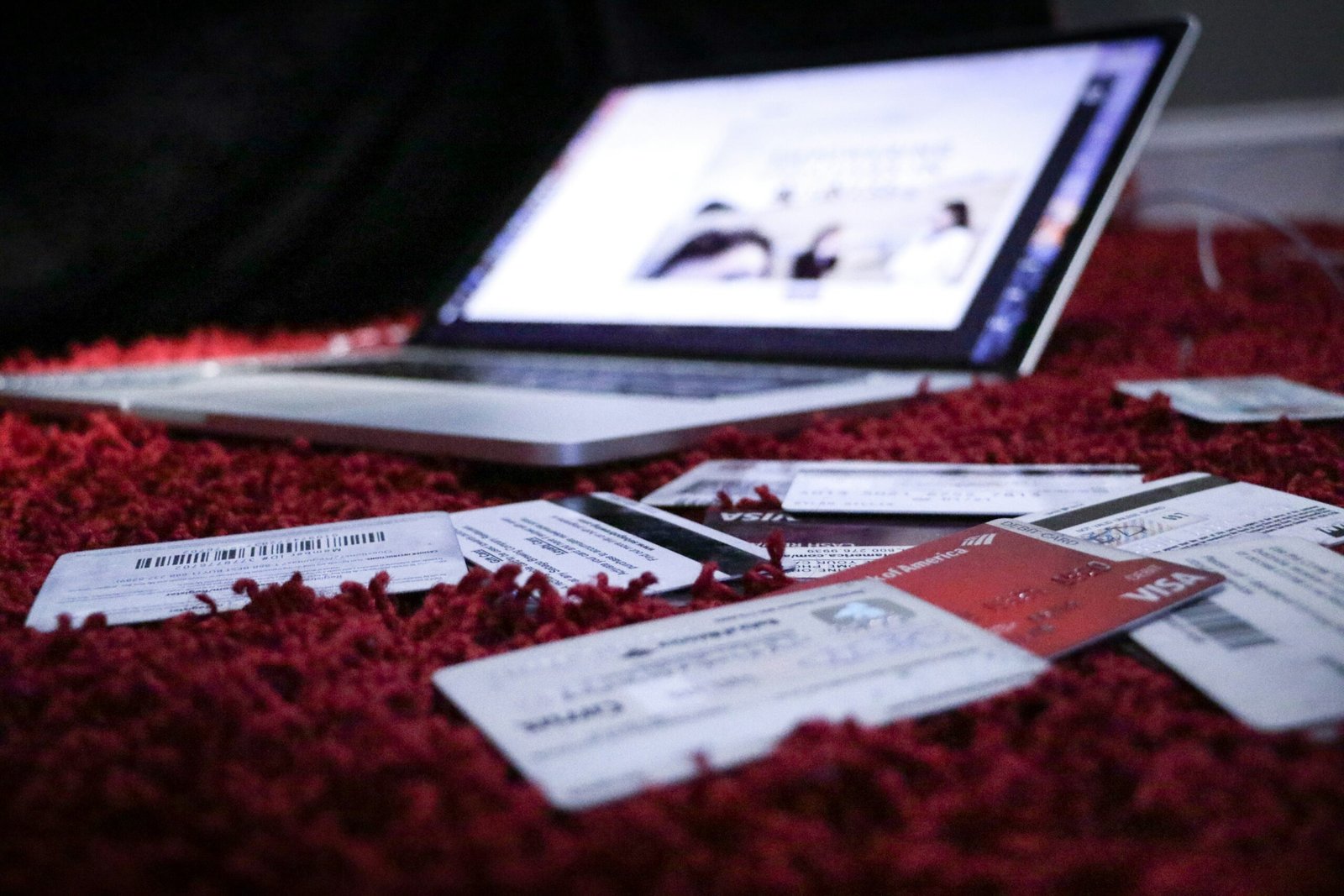

Having a good credit score is crucial when it comes to financial stability and achieving your goals. Whether you’re applying for a loan, renting an apartment, or even getting a new job, your credit score plays a significant role in determining your eligibility and the terms you’ll be offered.

If you’re wondering how to check your credit score in the USA, you’ve come to the right place. In this article, we’ll walk you through the steps to access your credit score and provide some tips on how to improve it.

1. Understand the Importance of Credit Scores

Before we dive into the process of checking your credit score, it’s essential to understand why it matters. Your credit score is a three-digit number that represents your creditworthiness. It is based on your credit history, including your payment history, credit utilization, length of credit history, and types of credit used.

A high credit score indicates that you have a history of responsible borrowing and are likely to repay your debts on time. On the other hand, a low credit score suggests that you may be a risky borrower.

2. Know Your Rights

Before checking your credit score, it’s important to know your rights as a consumer. Under the Fair Credit Reporting Act (FCRA), you are entitled to a free credit report every 12 months from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

While your credit report contains detailed information about your credit history, it does not include your credit score. However, you can purchase your credit score from the credit bureaus or use free online services that provide credit scores based on their calculations.

3. Choose a Credit Monitoring Service

There are several credit monitoring services available that provide access to your credit score and credit reports. These services offer additional features such as identity theft protection, credit score tracking, and personalized recommendations for improving your credit.

When choosing a credit monitoring service, consider factors such as cost, reputation, and the features they offer. Look for services that provide regular updates and alerts about changes to your credit report, as this can help you identify and address any issues promptly.

4. Sign Up and Verify Your Identity

Once you’ve selected a credit monitoring service, sign up for an account and verify your identity. This typically involves providing personal information such as your name, address, Social Security number, and date of birth.

It’s important to choose a reputable credit monitoring service that takes privacy and security seriously. Look for services that use encryption to protect your data and have robust security measures in place to prevent unauthorized access.

5. Access Your Credit Score

After signing up and verifying your identity, you’ll be able to access your credit score. Depending on the service you choose, you may also have access to your credit reports from all three major credit bureaus.

Take the time to review your credit score and reports carefully. Look for any errors or discrepancies that could be negatively impacting your credit. If you find any inaccuracies, you have the right to dispute them and have them corrected.

6. Improve Your Credit Score

If your credit score is lower than you’d like it to be, don’t worry. There are steps you can take to improve it over time:

- Pay your bills on time: Late payments can have a significant negative impact on your credit score. Make sure to pay all your bills by their due dates.

- Reduce your credit utilization: Aim to keep your credit card balances below 30% of your available credit limit.

- Build a positive credit history: Use credit responsibly by making small purchases and paying them off in full each month.

- Avoid opening too many new accounts: Opening multiple accounts within a short period can be seen as a red flag by lenders.

- Monitor your credit regularly: Keep an eye on your credit reports and scores to catch any issues early on.

Improving your credit score takes time and effort, but the benefits are well worth it. A higher credit score can lead to better loan terms, lower interest rates, and more financial opportunities.

Conclusion

Checking your credit score in the USA is an important step towards financial well-being. By understanding the process and taking steps to improve your credit, you can set yourself up for success and achieve your financial goals.

Remember, your credit score is not set in stone. With responsible financial habits and regular monitoring, you can make positive changes and build a strong credit history.